My Professional Journey

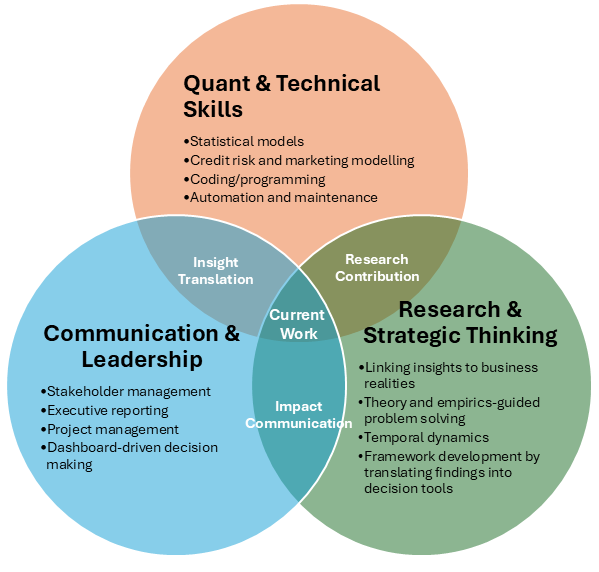

If there’s one thing I’ve learned over the years, it’s that some stories are easier to show than tell. That is why I made this Venn diagram. It sums up how different parts of my journey have come together.

Before starting my PhD, I worked on projects with government agencies, where I learned how data, policy, and decision-making intersect. That experience taught me the importance of impact communication, how to translate numbers into stories that actually drive action.

Then came my PhD journey, which took me deep into retail pricing, omnichannel behavior, and platform engagement. It sharpened how I think about context, behavior, and timing, and it taught me to turn complex findings into frameworks that make sense. I also got better at insight translation: making technical results digestible for non-technical audiences. Whether it’s a dashboard, a short briefing, or an executive summary.

Now, at my current role, everything comes together. I develop monitoring frameworks and keep models in check and make sure our analytics stay reliable and scalable. It’s where I bring together analytical rigor, research thinking, and clear communication to ensure the models we trust actually drive better decisions.

About Me